Investing in the stock market can be a great way to grow your wealth over time. However, it's important to approach it with knowledge and caution. Here are 10 lessons to keep in mind when investing in the stock market:

1. Educate Yourself: Take the time to learn about the stock market, including fundamental analysis, technical analysis, and different investment strategies. The more you know, the better equipped you'll be to make informed decisions.

2. Set Clear Goals: Define your investment goals, whether they're long-term wealth accumulation or short-term gains. Having a clear objective will help guide your investment decisions.

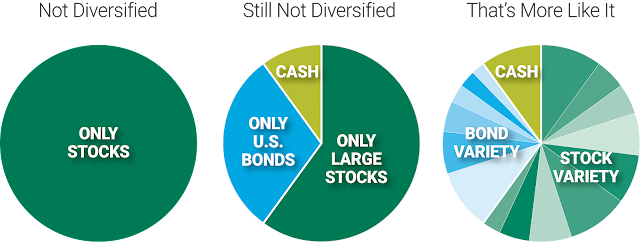

3. Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your investments across different sectors, industries, and asset classes to reduce risk. This way, if one investment performs poorly, others may compensate for it.

4. Invest for the Long Term: The stock market is known for its volatility, but over the long run, it has historically provided solid returns. Avoid getting caught up in short-term market fluctuations and focus on the long-term potential of your investments.

5. Practice Patience: Investing is not a get-rich-quick scheme. It takes time for investments to grow and generate significant returns. Be patient and avoid making impulsive decisions based on short-term market movements.

6. Understand Risk Tolerance: Assess your risk tolerance before investing. Consider how much you can afford to lose and how comfortable you are with market fluctuations. Adjust your investment strategy accordingly to align with your risk tolerance.

7. Research and Analyze: Before investing in a particular stock, conduct thorough research and analysis. Consider factors such as the company's financial health, management team, competitive position, and industry trends. This will help you make more informed investment decisions.

8. Keep Emotions in Check: Emotions can cloud judgment and lead to irrational investment decisions. Avoid making impulsive trades based on fear or greed. Stick to your investment plan and avoid emotional reactions to short-term market movements.

9. Stay Updated: Stay informed about the companies you've invested in, as well as broader market trends. Read financial news, quarterly reports, and analyst opinions to stay updated on relevant information that may impact your investments.

10. Monitor and Review: Regularly review your investment portfolio and make necessary adjustments. Monitor the performance of your investments, assess whether they align with your goals, and consider rebalancing if needed.

Remember, investing in the stock market involves risk, and there are no guarantees of returns. Consider consulting with a financial advisor to get personalized advice based on your specific financial situation and goals.

Top Brands

No comments:

Post a Comment